HOW CAN WE HELP YOU?

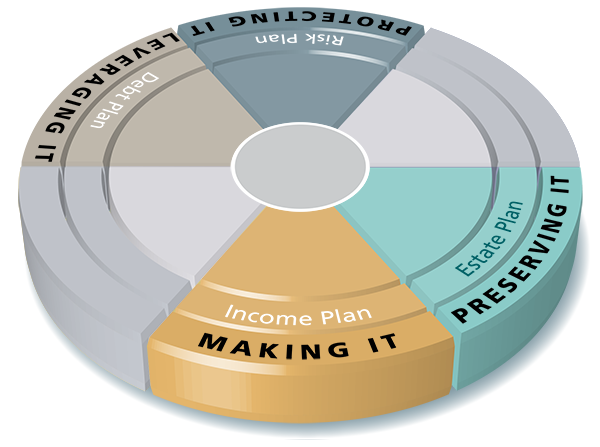

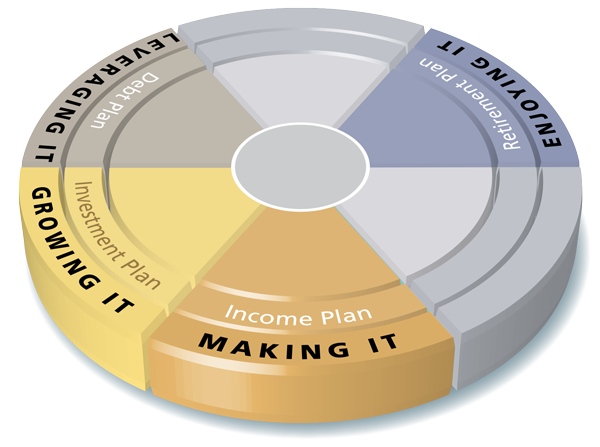

You're building a career and/or a life together planning for your financial future

Aged in 20s and 30s

Working on your career and enjoy having a reliable income

May be paying off a mortgage, loans, credit cards, cars etc

Aware of how difficult it is to save and get into your first home

May be renting or living at home with parents

Thinking about combining finances and/or starting a family

Would like to manage your expenses and make provisions for your financial future

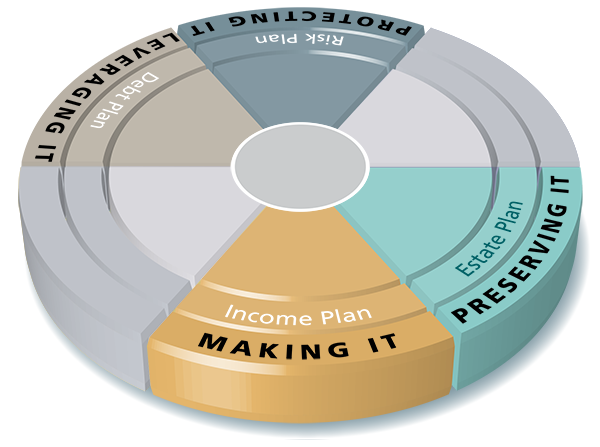

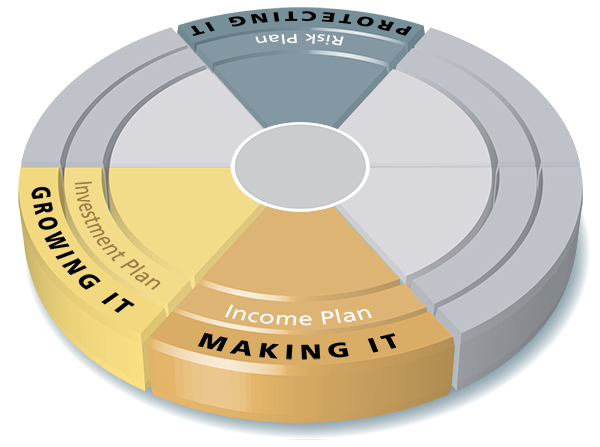

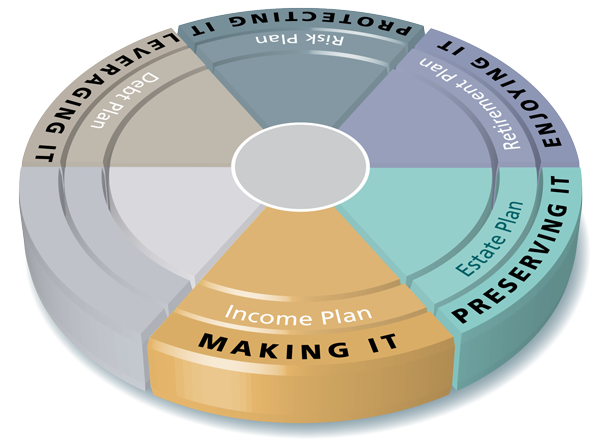

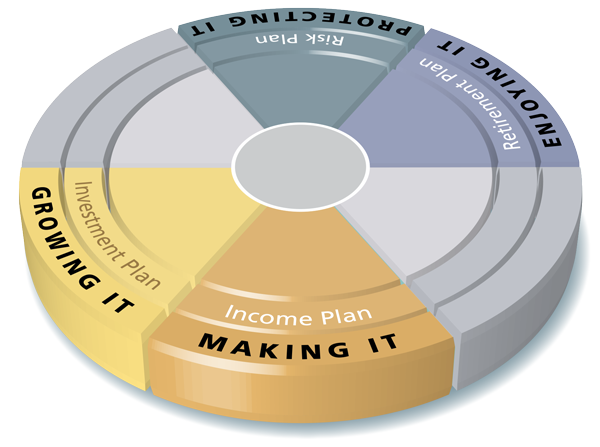

Your career is doing well and you want to ensure your family is protected

Aged in 20s, 30s or 40s

Want to provide financial security for your family but with a tight budget

Need to protect assets that you have worked hard to build

Need to protect income in case you can't work for an extended period

Would like to allocate education funding

May have reduced income due to one or both partners reducing working hours to look after children

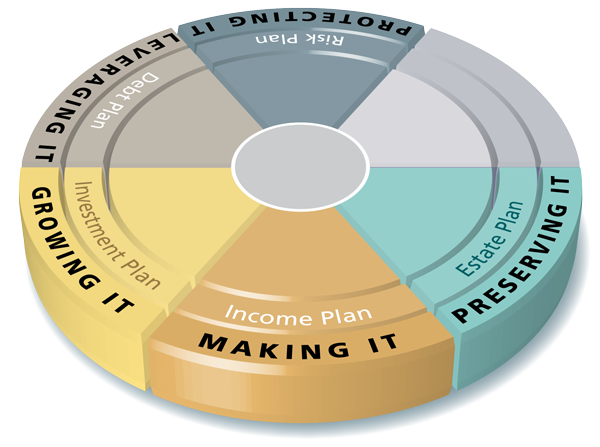

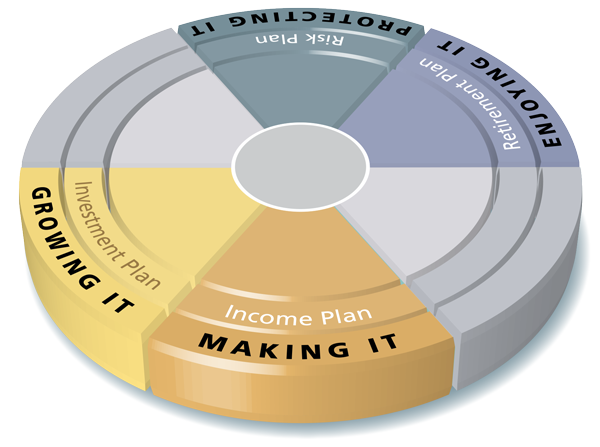

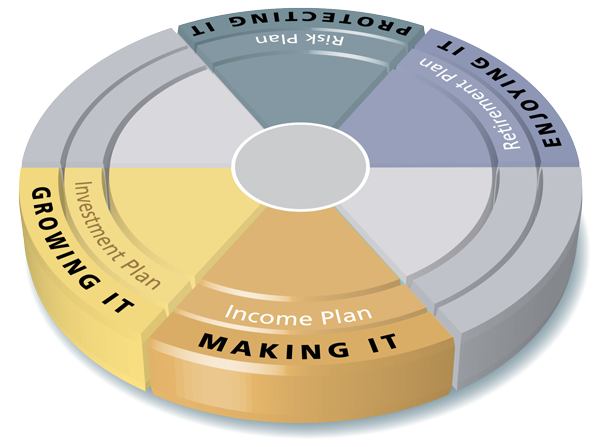

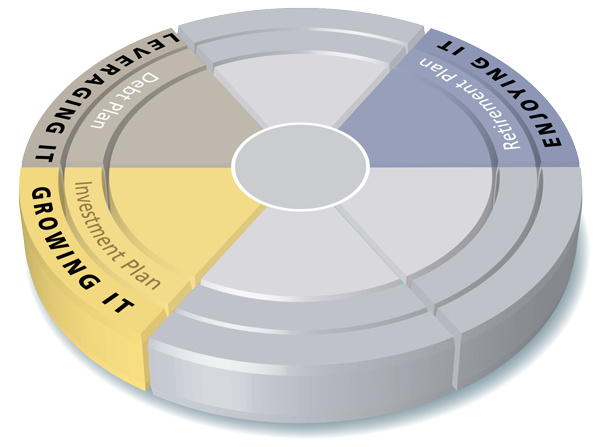

You want to balance growing your career with celebrating your success

Aged in 30s, 40s or 50s

Medical specialist, lawyer, accountant, engineer, architect

May have established your own business or practice

Developing your stake in the business

Have enjoyed financial success

Open minded, approachable and appreciate good advice

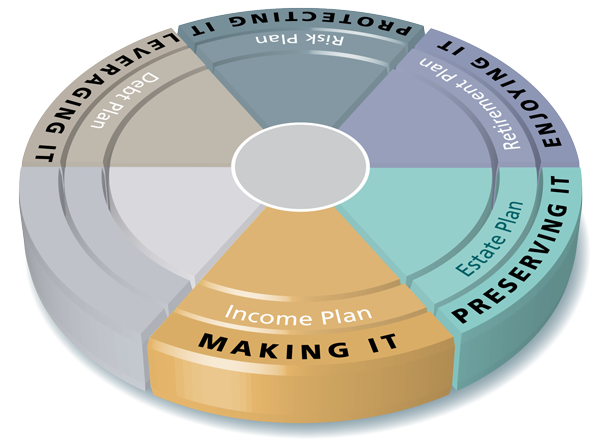

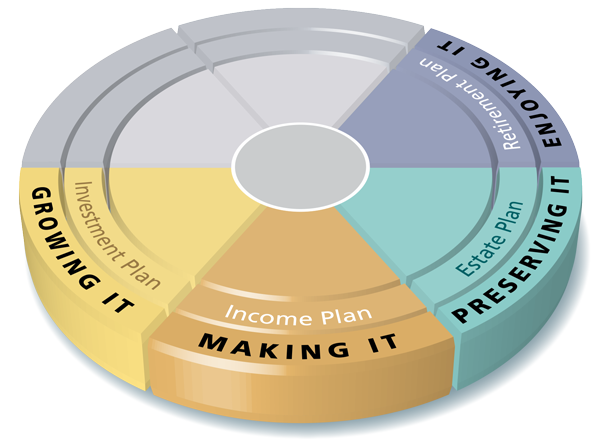

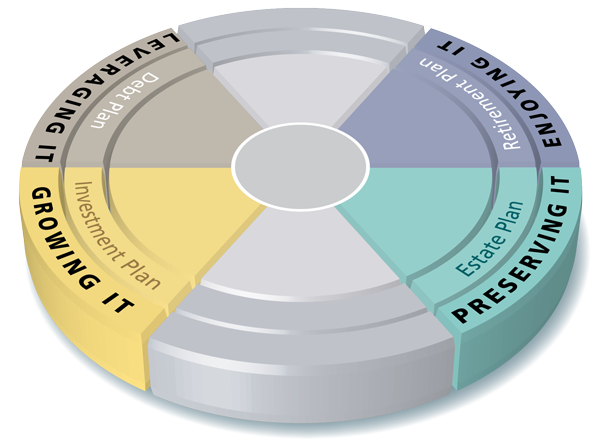

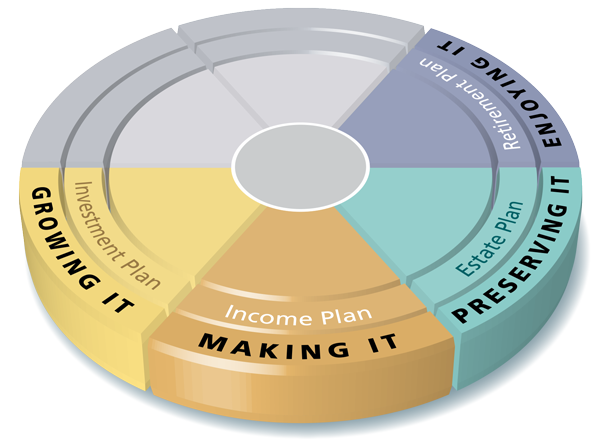

You are looking to stop working and want to plan for your future

Aged in 40s, 50s or 60s

Enjoy a successful career but don't want to work forever

Have started to talk about how to fund your retirement

May have money to invest and are keen to improve financial knowledge

May have investments and are concerned with the volatility in the share market

Want help planning for the future - education, renovations, travel, retirement

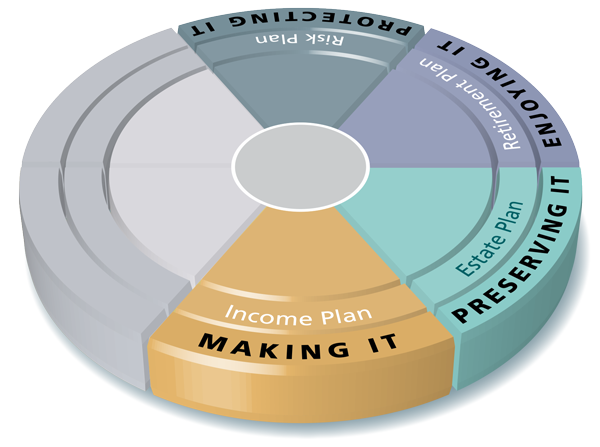

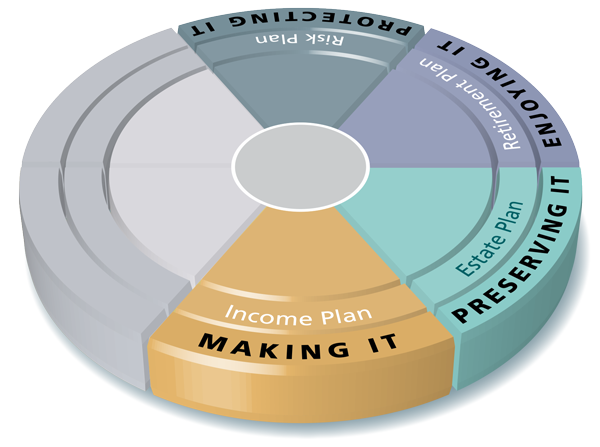

You want to enjoy what you have worked so hard for over your career

Aged in 50s, 60s or 70s

Have retired or are just about to

Want to enjoy the fruits of your labour and need help managing retirement income, including advice about social security

May have Super as well as other investments such as managed funds, shares and property

Would like to make sure Estate planning affairs are in order

HOW CAN WE HELP YOU?

We pride ourselves on providing unique FINANCIAL tailored solutions to meet your key goals and objectives (for Australian Residents & EXPATS), as well as offering guidance to help keep you on track towards those goals

Select a life event below...

See what areas are affected...

And what you need to consider...

- Select your life event

- Save for a deposit

- Getting married

- Buy a house

- Start a family

- Receive a pay increase

- Children's education costs

- Buy an investment property

- Start a business

- Children leave home

- Sell an asset

- Mortgage paid off

- Divorce

- Receive an inheritance

- Reach age 50

- Reach age 56

- Reach age 60

- Retirement

- Aged care

We can help you…

Select from the life events to see how we can help you.

We can help you…

Select from the life events to see how we can help you.

Save for a deposit

We can help you…

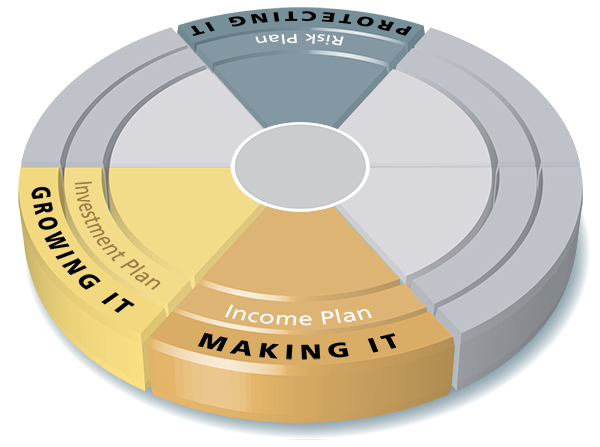

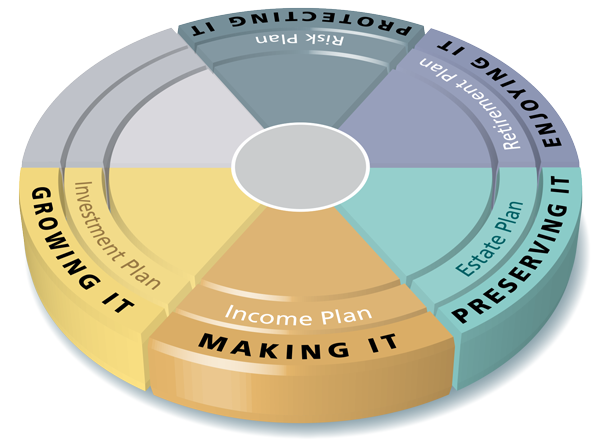

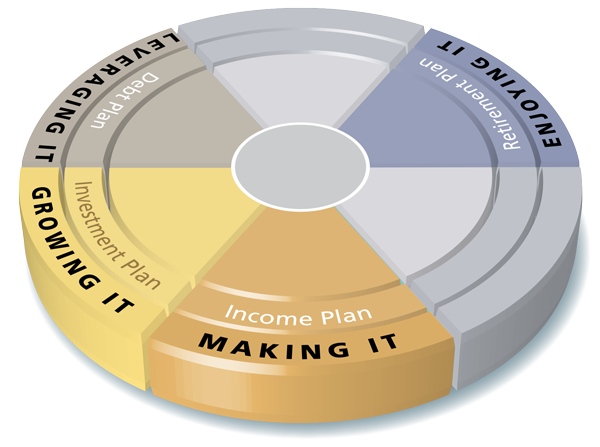

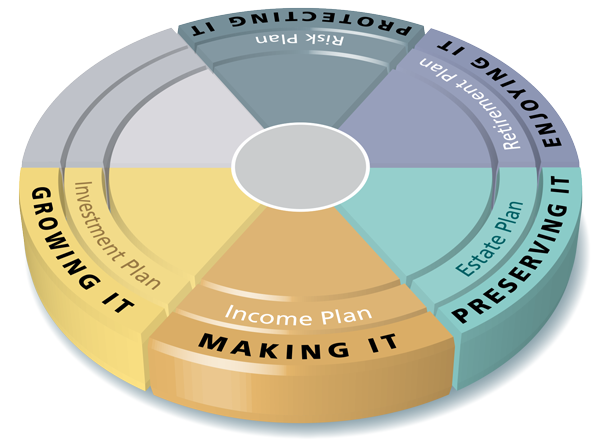

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

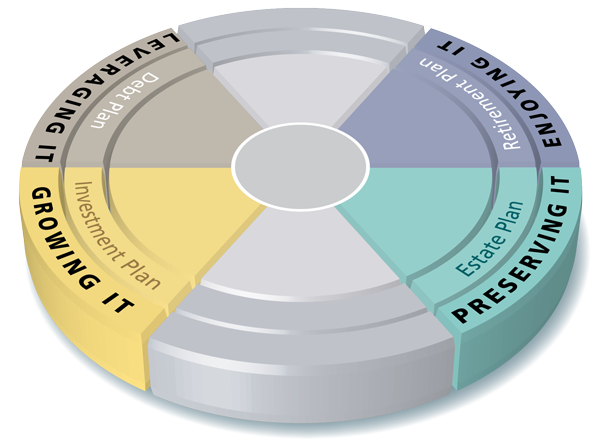

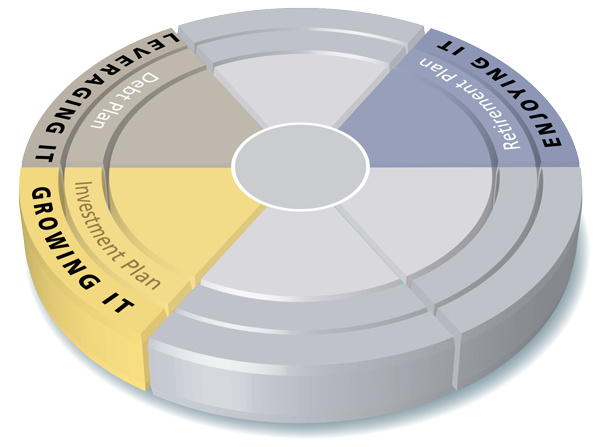

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

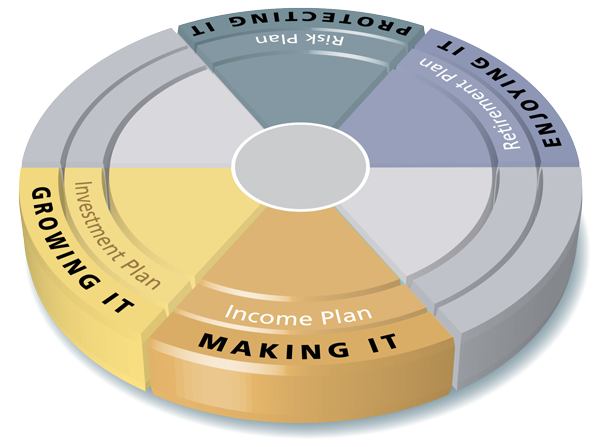

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

Getting married

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Buy a house

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

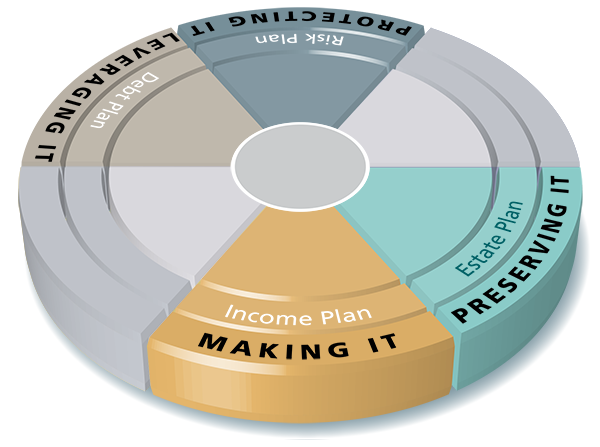

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Start a family

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Receive a pay increase

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth

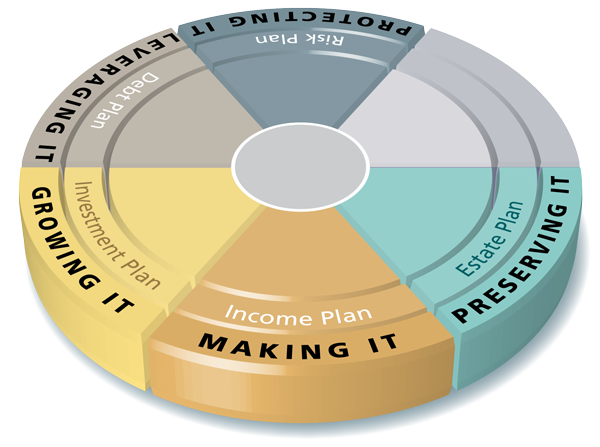

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

Children’s education costs

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

Buy an investment property

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Start a business

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

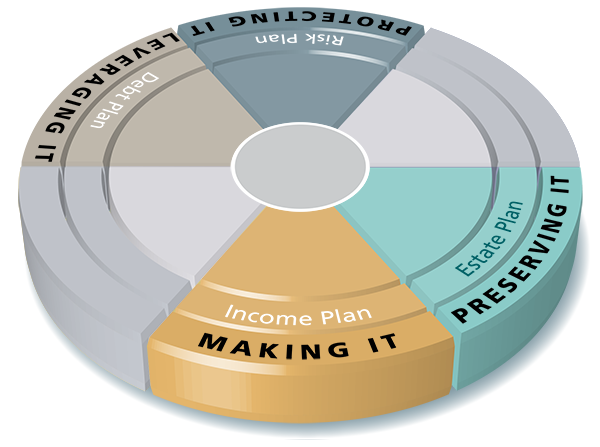

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Children leave home

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Sell an asset

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

Mortgage paid off

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

Divorce

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Receive an inheritance

We can help you…

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Reach age 50

We can help you…

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

Reach age 56

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

Reach age 60

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Retirement

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Aged care

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

WHAT CAN A FINANCIAL ADVISER DO FOR YOU?

Learn more about the financial planning process and how we could be of benefit to you.

HOW CAN WE HELP YOU?

We pride ourselves on providing unique FINANCIAL tailored solutions to meet your key goals and objectives (for Australian Residents & EXPATS), as well as offering guidance to help keep you on track towards those goals

Select a life event below...

See what areas are affected...

And what you need to consider...

- Select your life event

- Save for a deposit

- Getting married

- Buy a house

- Start a family

- Receive a pay increase

- Children's education costs

- Buy an investment property

- Start a business

- Children leave home

- Sell an asset

- Mortgage paid off

- Divorce

- Receive an inheritance

- Reach age 50

- Reach age 56

- Reach age 60

- Retirement

- Aged care

We can help you…

Select from the life events to see how we can help you.

We can help you…

Select from the life events to see how we can help you.

Save for a deposit

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

Getting married

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Buy a house

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Start a family

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Receive a pay increase

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

Children’s education costs

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

Buy an investment property

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Start a business

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Children leave home

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Sell an asset

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

Mortgage paid off

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

Divorce

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Receive an inheritance

We can help you…

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Reach age 50

We can help you…

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

Reach age 56

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

Reach age 60

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Retirement

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Debt Plan to eliminate your mortgage and create wealth.

Your debt plan analysis your current debt structure, determines mortgage reduction strategies and explores how debt can be used to build your wealth.

We use your Risk Plan to protect the things that are important to you.

Your risk plan looks at what could go wrong in your financial circumstances and seeks to identify and where possible mitigate these risks. Some of the ways these risks can be managed are through; implementing life insurance, recommending appropriate investments and possibly fixing interest rates.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

Aged care

We can help you…

We use your Income Plan to free up surplus funds to achieve your goal.

Your income plan determines strategies to improve your cash flow through a combination of tax effective strategies and the efficient use of your income. The resulting surplus funds are then used to create wealth.

We use your Investment Plan to explore your investment options and empower you to choose what’s best for you.

Your investment plan explores the different options available to you and applies the income plan and debt plan analysis to help you meet or exceed your goals.

We use your Retirement Plan to help you achieve your ideal retirement.

Your retirement plan identifies your income needs in retirement and the level of assets required to provide this income. We work with you to achieve and sustain the lifestyle you require.

We use your Estate Plan to ensure that the right assets, go to the right people, at the right time.

Your estate plan articulates your wishes in the event of your death and determines a strategy to provide your family with funds in a tax effective manner and with asset protection as a priority.

WHO WE ARE

We are a boutique Financial Adviser with a non-institutional mandate and a large approved product list to ensure that the advisers are able to provide expert advice to their valued clients.

At Equity & Law WEALTH, we are passionate about helping our valued clients (in & out of Australia) obtain a secure financial future. We achieve this due to having the required financial knowledge fit for the 21st century, long standing experience and our approach to ethics and professionalism in Financial Advice.

Our firm’s slogan is Where Experience meets Education and Ethics! It sums up the way in which we help our clients achieve their dreams, goals and aspirations. The founder has 3 decades of experience, all the required education, plus much more and places the clients in the center of everything we do.

Our Mission

To secure our client’s and their families’ financial future by understanding their needs and wants by integrating our experience and knowledge of the real financial world to produce advice fit for the 21st century.

Our Vision

To be known as the most ‘knowledgeable’, ‘expert driven’ and ‘ethical’ Financial Planner in the region.

Our Values

Organization: To work smart and hard

Non-institutional alignment: To provide an extensive product list.

Customer Service: To provide our clients a 5-star service.

Professionalism: Continuing Professional development of its employees.

Confidentiality: To keep client data confidential and up to date.

MEET THE FOUNDER

Boris Barna is an industry-recognised, accomplished Financial Planner with more than 29 years’ experience in helping clients and their families secure a sound financial future with core competencies in strategic financial planning and business development.

With his dedication to providing quality financial advice to individuals and companies, he has received various awards in Australia, UK, and Middle East and for his technical knowledge and customer service approach, some of these include:

- Nominated for the 2010 Victoria Student of the Year on completion of the Advanced Diploma in Financial Planning by the Australian Financial Association.

- British Excellence Award Winner (2006) for promoting British financial services in Kuwait. The award was presented by His Royal Highness the Duke of York at the British Embassy in Kuwait on the 4th March 2007.

QUALIFICATIONS & CERTIFICATES:

Australia

- Successfully passed the FASEA industry exam, a detailed 3-hour exam that all Financial Advisers must pass in order to offer Financial Planning Advice to retail clients.

- SMSF Specialist Adviser – SMSF Association. The exam is recognised industry wide as a comprehensive and challenging test of an individual’s ability as an SMSF advisor.

- Advanced Diploma of Financial Services

- Diploma of Financial Services

- Diploma in Finance & Mortgage Broking Management

- Tax for Financial Advising & Commercial LAW

- Ethics & Professionalism in Financial Advice – Applied and Professional Ethics

- Accredited Listed Product Adviser (ASX ALPA) Program

- Business Succession Planning

United Kingdom

- Master of Business Administration (MBA), Finance & Accounting – University of Liverpool, England

- Full UK Financial Planning Certificate – Chartered Institute of Insurance

How We Do It

We accomplish our client’s financial goals through following six careful steps by utilising both technical and soft skills in an organised manner which requires strong work ethic and to put our client’s interest first

Take the first step on your financial journey.

LATEST NEWS

View the latest news from Equity & Law WEALTH

CLIENT RESOURCES

Use our free online tools to create budgets, manage your finances and transfer files through to us

USEFUL LINKS

We’ve compiled a broad range of useful links for your use. These include tax resources, finance, media, Australian government assistance, business and accounting software.

USEFUL LINKS

Expat Useful Links

Our 6 Step Financial Process to Sound Advice helps us to help expats with all their financial needs!

- Deceased estates and capital gains tax

- Calculating non-resident foreign income for study or training loans

- Taxation of trust net income – non-resident beneficiaries

- CGT exemptions for inherited dwellings (for residents)

- Foreign resident withholding – who it affects

- Foreign residents’ exemption from Medicare levy

Contact us today to discuss how we can work together: (03) 9016 9102 or email us at contactus@equityandlawwealth.com

VIDEOS & ADS

Watch our educational financial planning videos, and check out our TV ad spots!

VIDEOS & ADS

Contact us today to discuss how we can work together: (03) 9016 9102 or email us at contactus@equityandlawwealth.com

GENERAL CALCULATORS

Powered by ASIC’s MoneySmart, these FREE calculators can help give you direction and motivate you to achieve your financial goals.

GENERAL CALCULATORS

Please enjoy the links to these free tools supplied by MoneySmart - a great resource for general financial information. Please get in touch if you would like to discuss any questions that you may have as a result of using these calculators.

Superannuation

- Retirement planner

(how to boost your super) - Superannuation calculator

(how fees affect your payout) - Super contributions optimiser

- Super vs mortgage calculator

- Super co-contribution calculator

- Employer contributions calculator

Investing

Borrowing and credit

- Mortgage calculator

- Mortgage switching calculator

- Mortgage health check

- Personal loan calculator

(also suitable for car loans) - Credit card calculator

EBOOK DOWNLOADS

Contact Us

Let our experts strengthen your financial future

Equity & Law WEALTH welcomes your enquiry. To book an appointment or simply ask us a question, fill in your details and we’ll be in touch soon!

EMAIL, PHONE & FAX

OFFICE ADDRESS

SEND YOUR ENQUIRY

Add Your Heading Text Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.